The challenge of assessing the UK economy’s dependence on mineral supply

Critical, essential, or just plain important? Dr Gavin Mudd, director of the Critical Minerals Intelligence Centre, discusses the findings and new methodology featured in the 2024 UK Criticality Assessment.

28/11/2024 By BGS Press

The 2024 UK Criticality Assessment is out.

Commissioned by the Department for Business and Trade (DBT) ahead of the launch of their new Critical Minerals Strategy in 2025, the report is intended to evaluate the risk of disruption to the supply of minerals of key economic importance.

The outcome may not be one that everyone expected. It may even raise some eyebrows, as such assessments have done elsewhere in the world, and it will hopefully spark further scientific and policy discussion. I certainly hope it does.

Across the world, industry groups and active lobbies have championed the introduction of a particular material to such criticality lists, perceiving perhaps the ‘critical’ designation as a mark of prestige or privilege within an economy. Some have called on scientists to change their findings, to varying levels of success.

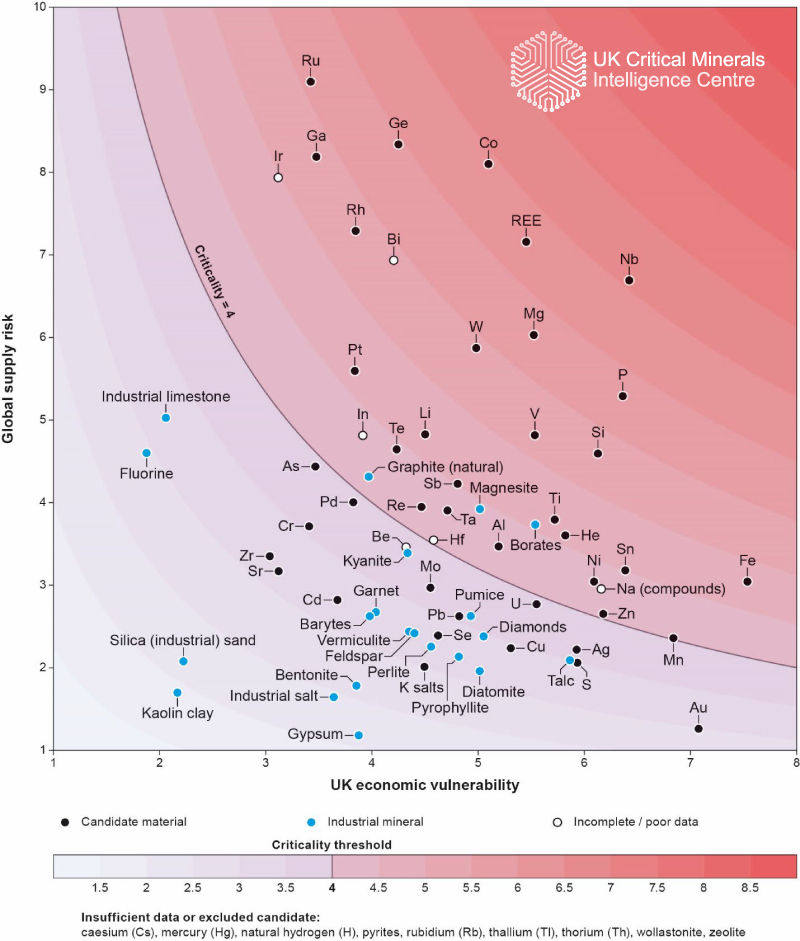

Our assessment identifies copper as not critical. This will likely, and understandably, be the focus of much attention — much as its omission in the 2023 USA assessment was. In similar lists focused on economies across the EU, Japan, India, China, Canada and now the USA, copper is identified as critical. Under the methodology within our report, the material did not meet the necessary threshold, as with Australia’s latest assessment.

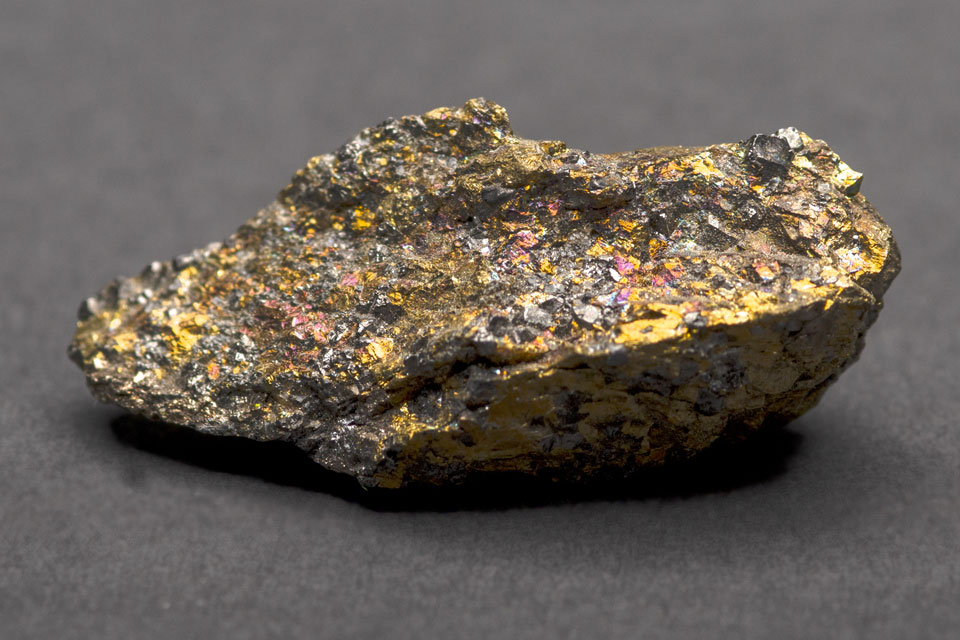

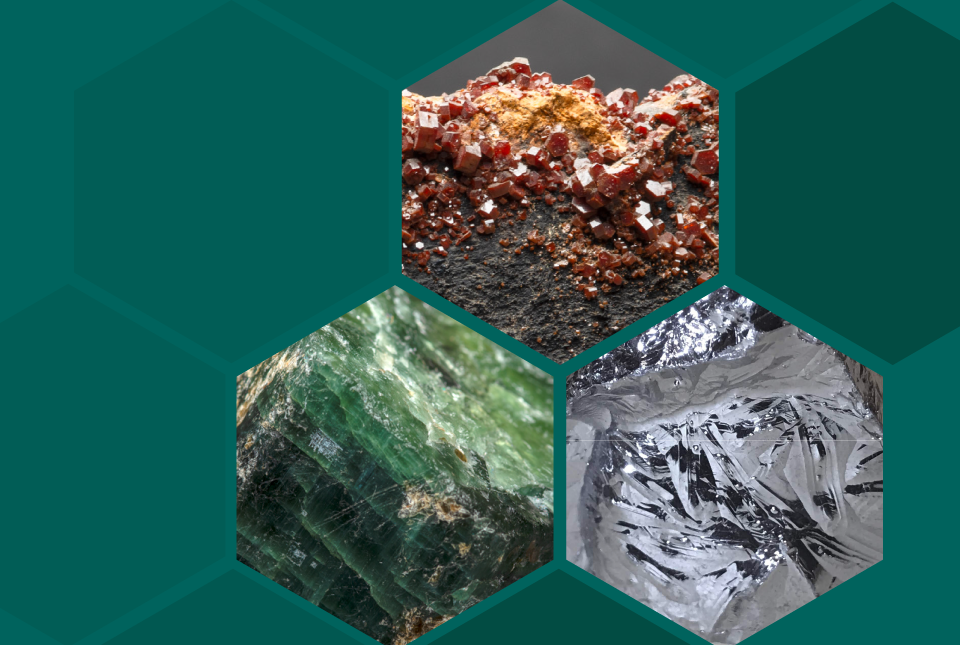

Chalcopyrite, one of the primary copper-bearing minerals. BGS © UKRI.

This is why it is important to understand the difference in definition between ‘essential’, ‘important’ and ‘critical’. The commodities evaluated as part of this assessment were selected precisely because of their significant importance to the UK economy, but for a mineral to be ‘critical’ it must be both important and subject to a significant supply risk.

The UK is reliant on international supply for most of the 82 assessed materials at the heart of this report, with 49 of them predominately provided through imports. The competition for certain minerals is increasing by the day: for example, global demand for lithium is expected to increase more than tenfold by 2050 to support the net zero energy transition.

This assessment is built on robust data. It is a snapshot of the UK’s present need, our current supply chains, and demand drive estimated by consumption and existing policy. This is a steadfast, impartial and empirical point from which decision makers can progress conversations around our future needs.

I see criticality as an ever-changing status in response to conditions. The ebb and flow of technological advancements, consumer demand, market forces, the drive for renewable energy sources and the geopolitical environment: all play a role in shaping demand and increasing the risks around supply.

Copper is an important and essential mineral to the UK economy. It has diversified uses, including power and electricity, telecommunications and digital technologies, as well as chemicals and infrastructure. Every home, office, factory and vehicle across the UK draws value from the use of copper every day. However, the 2024 UK Criticality Assessment aims to identify the minerals for which the UK economy is currently most vulnerable. In simple terms, this means those minerals that have a higher risk of supply disruption and could prompt significant economic upheaval for the UK should a disruption occur.

Against that measure, based on the scientific data used in our report, copper is not critical. Through available data, projections of refined copper production can be judged likely to meet copper demand for the relevant policies and announced pledges scenarios.

The new UK Criticality Assessment’s criticality matrix. BGS © UKRI.

This assessment recognises that concerns around the capacity to increase global copper mine supply may lead to an increased global supply risk and, in turn, result in copper becoming critical in the future. When the data shows this point is reached, such assessments will reflect it. The dynamic nature of criticality also mean we need other types of assessments and studies, for example forecasting studies for certain minerals, and CMIC is already planning several of these.

This report lives and dies by its adherence to a methodology that is impartial. In my eyes, it is a good thing that there appears a conscious effort to meet the global demand for copper. This is an indication that the global supply chain currently produces this essential material with a sound balance between supply and demand. With the UK seeking to enhance the National Grid to accommodate a higher proportion of renewable energy and electric vehicle charging capability, this country is clearly going to need a lot of it.

To meet global net zero greenhouse gas emission targets by 2050, we will need to increase copper mine supply by about 2 per cent above existing trends. Whilst this does not sound like much, it is recognised that there are challenges faced by the copper sector such as declining ore grades, water resources issues (for example, scarcity), and the increasing difficulty of developing large new copper projects.

This assessment is intended to stimulate discussion and allow us as a country to continue to plan effectively for the future of our economy and its place within an increasingly sophisticated and interconnected global supply chain. That discussion should be vigorous and impassioned; disagreement is an inevitable outcome. I look forward to taking part in such conversations.

I would invite all to see real success in terms of what the next criticality assessment might contain. A shorter list will be a clear indication that the UK has been successful in mitigating supply risk.

Relative topics

Related news

New interactive map viewer reveals growing capacity and rare earth element content of UK wind farms

16/05/2025

BGS’s new tool highlights the development of wind energy installations over time, along with their magnet and rare earth content.

Latest mineral production statistics for 2019 to 2023 released

28/04/2025

More than 70 mineral commodities have been captured in the newly published volume of World Mineral Production.

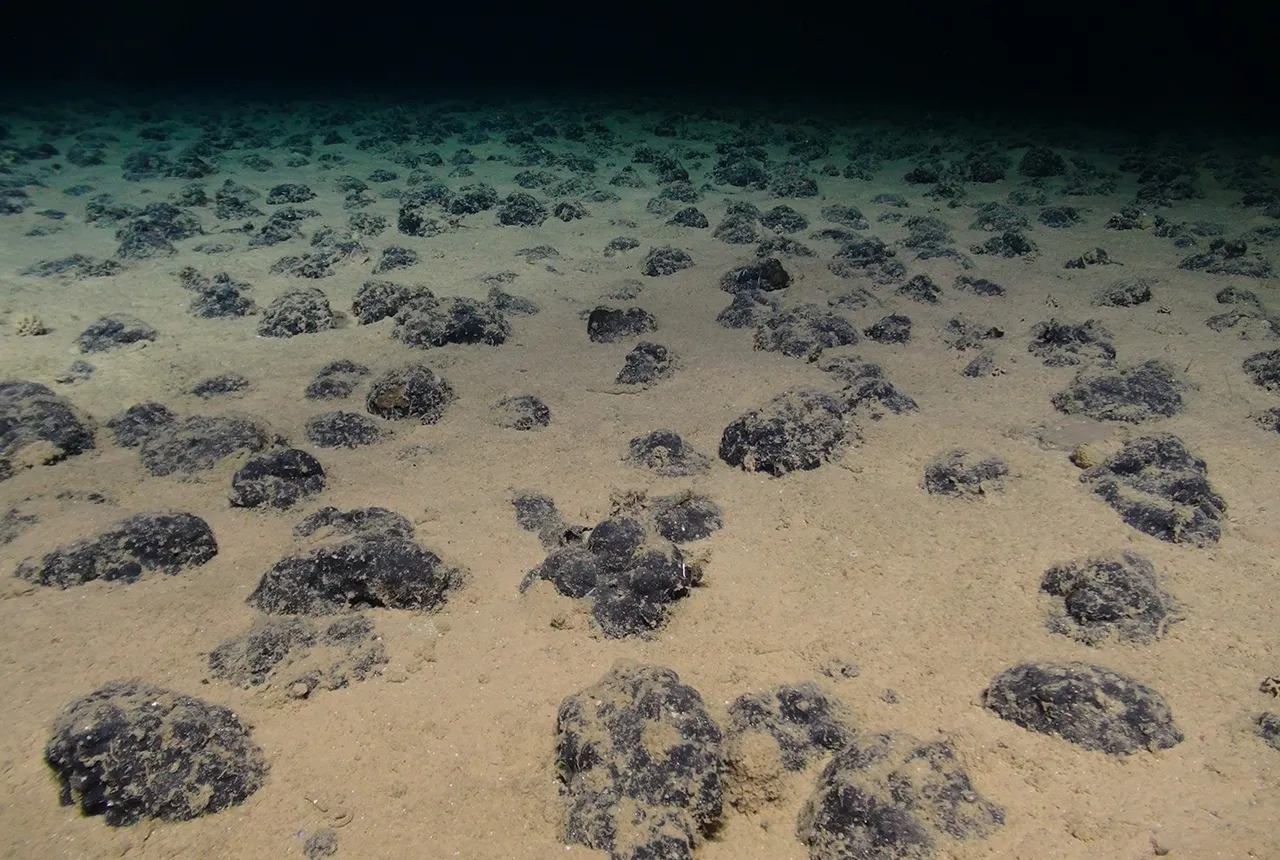

New study reveals long-term effects of deep-sea mining and first signs of biological recovery

27/03/2025

BGS geologists were involved in new study revealing the long-term effects of seabed mining tracks, 44 years after deep-sea trials in the Pacific Ocean.

Future projections for mineral demand highlight vulnerabilities in UK supply chain

13/03/2025

New Government-commissioned studies reveal that the UK may require as much as 40 per cent of the global lithium supply to meet anticipated demand by 2030.

Critical Mineral Intelligence Centre hosts second conference

28/02/2025

The Critical Minerals Intelligence Centre conference took place at BGS’s headquarters in Keyworth, Nottinghamshire.

Dr Kathryn Goodenough honoured with prestigious award from The Geological Society

27/02/2025

Dr Kathryn Goodenough has been awarded the Coke Medal, which recognises those who have made a significant contribution to science.

The challenge of assessing the UK economy’s dependence on mineral supply

28/11/2024

Critical, essential, or just plain important? Dr Gavin Mudd, director of the Critical Minerals Intelligence Centre, discusses the findings and new methodology featured in the 2024 UK Criticality Assessment.

UK 2024 Criticality Assessment published

28/11/2024

The latest UK Criticality Assessment, produced by the UK Critical Minerals Intelligence Centre, shows that growing diversification brings an increasing vulnerability in terms of disruption to supply.

Criticality Assessment 2024 launch webinar

Event on 28/11/2024

A special live webinar with the team from the Critical Minerals Intelligence Centre to accompany the launch the latest UK Criticality Assessment. A recording is now available to watch online

Mining sand sustainably in The Gambia

17/09/2024

BGS geologists Tom Bide and Clive Mitchell travelled to The Gambia as part of our ongoing work aiming to reduce the impact of sand mining.

Over 600 mineral exploration project reports now available through the UK Critical Minerals Intelligence Centre

17/05/2024

All 662 reports from the Mineral Exploration and Investigation Grants Act programme are now available on the Critical Minerals Intelligence Centre website.

BGS signs memorandum of understanding with Serviço Geológico do Brasil

10/04/2024

The partnership will advance the two organisations’ shared interests in mineral research and geoscience to help benefit society.