UK 2024 Criticality Assessment published

The latest UK Criticality Assessment, produced by the UK Critical Minerals Intelligence Centre, shows that growing diversification brings an increasing vulnerability in terms of disruption to supply.

28/11/2024 By BGS Press

The latest UK Criticality Assessment, published by the BGS-led UK Critical Minerals Intelligence Centre (CMIC), focuses on the vulnerability to supply disruption of minerals in an increasingly diversified UK economy. The analysis is intended to support policymakers in building economic resilience and securing minerals of importance to the UK economy and national security.

Critical minerals are essential in a wide range of products we rely on for our energy, transportation, home and work lives, defence and health care. The assessment was commissioned by the Department for Business and Trade (DBT) as part of the CMIC programme for 2024.

Criticality assessments are similar to risk assessments in that they aim to produce an evaluation of the potential for the disruption of the supply of minerals and the resulting economic impact. Indicators are quantified from a range of relevant metrics derived from reliable and publicly available data. Through this methodology, the assessment provides insights on the various factors that contribute to supply risk.

Tungsten (W): used in hard metals for cutting tools such as drill bits, superalloys, defence equipment and industrial catalysts. BGS © UKRI.

Cobalt (C0): used in superalloys, magnets, hard metals and the manufacture of rechargeable batteries, including those in hybrid and electric vehicles. BGS © UKRI.

Ferro-niobium: niobium (Nb) is used in alloys such as high-strength, low-alloy steel used to manufacture vehicle bodies. BGS © UKRI.

Apatite: a phosphorus-bearing mineral. Phosphorus (P) is used in plastics, the food industry, water and metal treatment and pharmaceuticals. Also used in fertilisers and alloying agents. BGS © UKRI.

The assessment builds on data used in a range of areas, including:

- diplomatic efforts to secure stable trade relationships

- supporting improved recycling capabilities as part of a more circular economy

- further investment in exploration, mining and processing

- the pursuit of alternative materials

Dr Gavin Mudd, director of the Critical Minerals Intelligence Centre, said that the assessment demonstrates the increasingly complex supply chains the UK relies on to support its economic activity.

This assessment confirms that the growing diversification of the UK economy — alongside the expanding reliance on global trade — brings an increasing vulnerability in terms of disruption to the supply of critical minerals.

There are similarities to other criticality assessment lists across the world, but the demands and challenges facing the UK economy are dynamic and we need to match the demand for minerals with sustainable and reliable supply.

Dr Gavin Mudd, CMIC Director.

I welcome the Critical Mineral Intelligence Centre’s assessment, which shows a sustainable supply of critical minerals will be more vital than ever.

That’s why next year we’ll launch a new Critical Minerals Strategy to help secure our supply chains for the long term and drive forward the green industries of the future.

Sarah Jones MP, Industry Minister.

UK Criticality Assessment 2024: 10 most critical minerals

| Ranking | Material | Applications |

| 1 | Niobium (Nb) | Alloys such as high-strength, low-alloy steel used to manufacture vehicle bodies |

| 2 | Cobalt (Co) | Superalloys, magnets, hard metals and the manufacture of rechargeable batteries, including those in hybrid and electric vehicles |

| 3 | Rare earth elements (REE) | Magnets and catalysts. Also common in high-tech devices such as smartphones and electronic displays, and used in defence technologies |

| 4 | Germanium (Ge) | Infrared optics, optical fibres and satellite solar cells. Also used to manufacture solid-state electronics and semiconductors |

| 5 | Magnesium (Mg) | Transportation, packaging, construction and as a desulfurisation agent. Found in products that benefit from lightweight properties, including car parts and cameras |

| 6 | Phosphorus (P) | Plastics, the food industry, water and metal treatment and pharmaceuticals. Also used in fertilisers and alloying agents |

| 7 | Ruthenium (Ru) | Electronics, chemicals and electrochemicals, and to make electronic contacts with a high degree of wear resistance. Also common in chip resistors and solar cells |

| 8 | Tungsten (W) | Hard metals for cutting tools such as drill bits, superalloys, defence equipment and industrial catalysts |

| 9 | Gallium (Ga) | Integrated circuits, optoelectronics, sensors and magnets. This includes the manufacture of solid-state electronics, semiconductors and fibre optic systems |

| 10 | Rhodium (Rh) | Catalytic converters for cars and in catalysts used in the chemical industry |

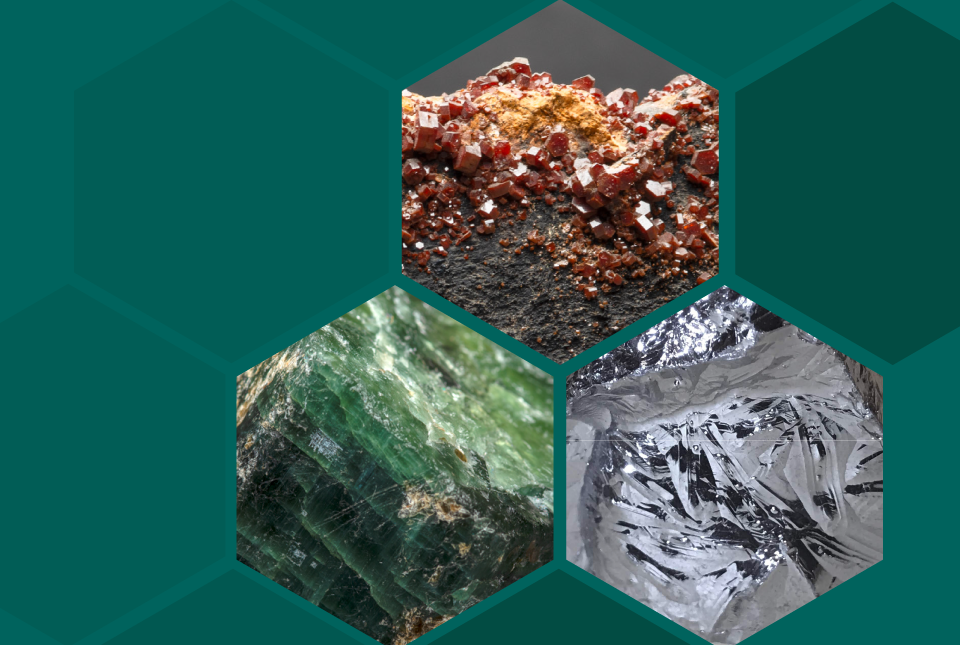

The 2024 UK Criticality Assessment finds that 34 minerals out of the 82 candidate materials assessed are ‘critical’. This is an increase relative to the 2021 assessment, where only 26 candidate materials were assessed and 18 assessed as critical.

Criticality matrix. BGS © UKRI

Of the 18 minerals classed as critical on the 2021 list, 17 remain critical in this new assessment — palladium is now below the criticality threshold — whilst notable additions in 2024 include nickel, iron, germanium, aluminium and chromium (plus others). The new list reflects the increased scope of assessment and the advances in the methodology used.

Dr Gavin Mudd, the director of CMIC, says the study has highlighted the diverse UK economy, driven by clean energy technology like wind turbines and electric vehicles and an increase in advanced manufacturing applications.

In particular, as the UK continues its efforts in decarbonisation of its economy, we are seeing significant shifts in numerous minerals as coal-fired power has now been closed and new technologies are being used. This brings both benefits and risks to the UK.

Dr Gavin Mudd, CMIC Director.

The report highlights several issues that should be the focus of further consideration.

Technology-driven mineral demand

The pursuit of new energy and transport technologies lies at the heart of decarbonisation efforts and is creating significant demand for additional critical minerals. These include the use of lithium-ion batteries in electric vehicles or rare earth elements used in the permanent magnets in drive trains for electric vehicles and wind turbines. Other sectors fueling technical advances through the use of critical minerals includes aerospace and defence, which require specialist alloys that can withstand extreme conditions, whilst the rise in the use of artificial intelligence and the linked demand on large data centres has also prompted a considerable increase in the demand for minerals with a high criticality score within the assessment.

Decarbonisation effects on mineral demand

With an intrinsic link between climate change and the extraction of minerals, the drive to achieve net zero commitments and the transition towards a low-carbon society, reducing our carbon emissions and our dependence on fossil fuels will require a greater global supply of minerals. It is recognised that the manufacture of technologies such as wind turbines and electric vehicles is a mineral-intensive process and, as such, the mineral demand for these clean energy technologies is anticipated to increase significantly. Some estimates suggest a quadrupling of demand by 2040 in a scenario in which net zero carbon emissions are achieved by 2050. Clean energy technologies are the predominant driver of growth in demand for many critical minerals.

Trade regulations and global supply risks

Trade regulations can significantly disrupt global critical mineral supply chains and trade, therefore carrying the potential to cause shortages and price volatility. The extent of any disruption on the supply of critical minerals would depend on the nature of the regulations, their timing and the duration of their application. As the UK economy is demonstrably more vulnerable to disruption in the flow of key materials from international markets, it is also more vulnerable to the effects of global trade measures and regulations. Furthermore, the UK’s critical minerals refining and manufacturing capacity being in its nascent stages potentially heightens this vulnerability.

Recycling potential

The ability to employ recycling as a means to bolster supply for the candidate materials assessed in this study varies significantly, ranging from zero to a maximum of 95 per cent. The UK imports and exports waste and scrap flows for a range of materials, derived from related processing and manufacturing activities. Overall, the area of recycling needs a greater capacity to synthesise data, monitor material flows through the economy and explore opportunities to improve the circularity of the UK economy.

Climate change and its impact on global supply risks

Climate change poses significant risks to the global supply of critical metals and minerals needed for clean energy technologies and the transition to a low-carbon economy. At present, it is causing more frequent extreme weather events than ever before, such as drought, heat, flooding and changing precipitation patterns. All these events have a direct impact on mining operations and minerals processing and transportation. Climate change risks could potentially impede the trajectory of clean energy transitions if the supply of critical metals cannot meet rapidly growing demand, and may have a significant impact on the economy’s ability to implement low-carbon technologies like solar panels, wind turbines and electric vehicle batteries.

The full UK 2024 criticality assessment is available to download through the CMIC website.

Relative topics

Related news

Funding awarded to UK/Canadian critical mineral research projects

08/07/2025

BGS is part of a groundbreaking science partnership aiming to improve critical minerals mining and supply chains.

New interactive map viewer reveals growing capacity and rare earth element content of UK wind farms

16/05/2025

BGS’s new tool highlights the development of wind energy installations over time, along with their magnet and rare earth content.

Latest mineral production statistics for 2019 to 2023 released

28/04/2025

More than 70 mineral commodities have been captured in the newly published volume of World Mineral Production.

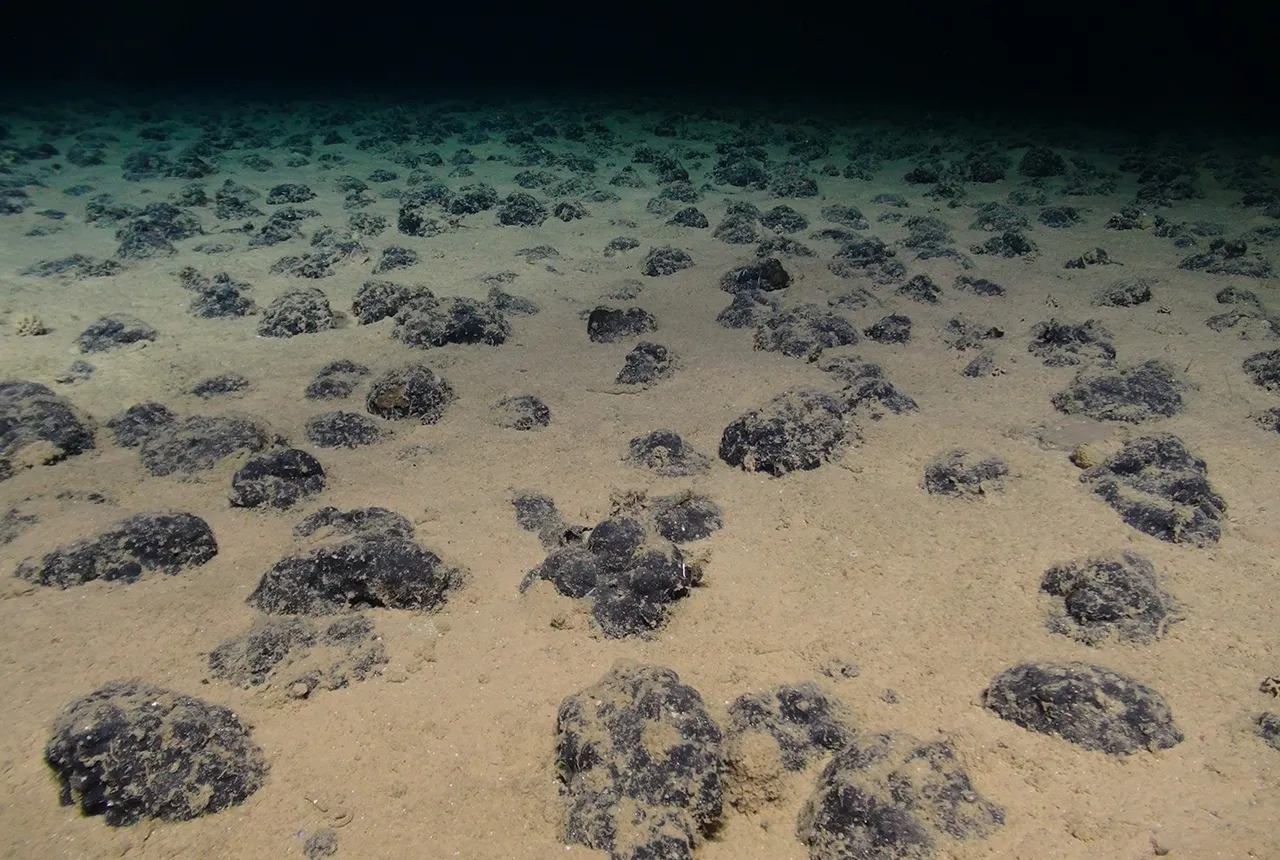

New study reveals long-term effects of deep-sea mining and first signs of biological recovery

27/03/2025

BGS geologists were involved in new study revealing the long-term effects of seabed mining tracks, 44 years after deep-sea trials in the Pacific Ocean.

Future projections for mineral demand highlight vulnerabilities in UK supply chain

13/03/2025

New Government-commissioned studies reveal that the UK may require as much as 40 per cent of the global lithium supply to meet anticipated demand by 2030.

Critical Mineral Intelligence Centre hosts second conference

28/02/2025

The Critical Minerals Intelligence Centre conference took place at BGS’s headquarters in Keyworth, Nottinghamshire.

Dr Kathryn Goodenough honoured with prestigious award from The Geological Society

27/02/2025

Dr Kathryn Goodenough has been awarded the Coke Medal, which recognises those who have made a significant contribution to science.

The challenge of assessing the UK economy’s dependence on mineral supply

28/11/2024

Critical, essential, or just plain important? Dr Gavin Mudd, director of the Critical Minerals Intelligence Centre, discusses the findings and new methodology featured in the 2024 UK Criticality Assessment.

UK 2024 Criticality Assessment published

28/11/2024

The latest UK Criticality Assessment, produced by the UK Critical Minerals Intelligence Centre, shows that growing diversification brings an increasing vulnerability in terms of disruption to supply.

Criticality Assessment 2024 launch webinar

Event on 28/11/2024

A special live webinar with the team from the Critical Minerals Intelligence Centre to accompany the launch the latest UK Criticality Assessment. A recording is now available to watch online

Mining sand sustainably in The Gambia

17/09/2024

BGS geologists Tom Bide and Clive Mitchell travelled to The Gambia as part of our ongoing work aiming to reduce the impact of sand mining.

Over 600 mineral exploration project reports now available through the UK Critical Minerals Intelligence Centre

17/05/2024

All 662 reports from the Mineral Exploration and Investigation Grants Act programme are now available on the Critical Minerals Intelligence Centre website.