Future projections for mineral demand highlight vulnerabilities in UK supply chain

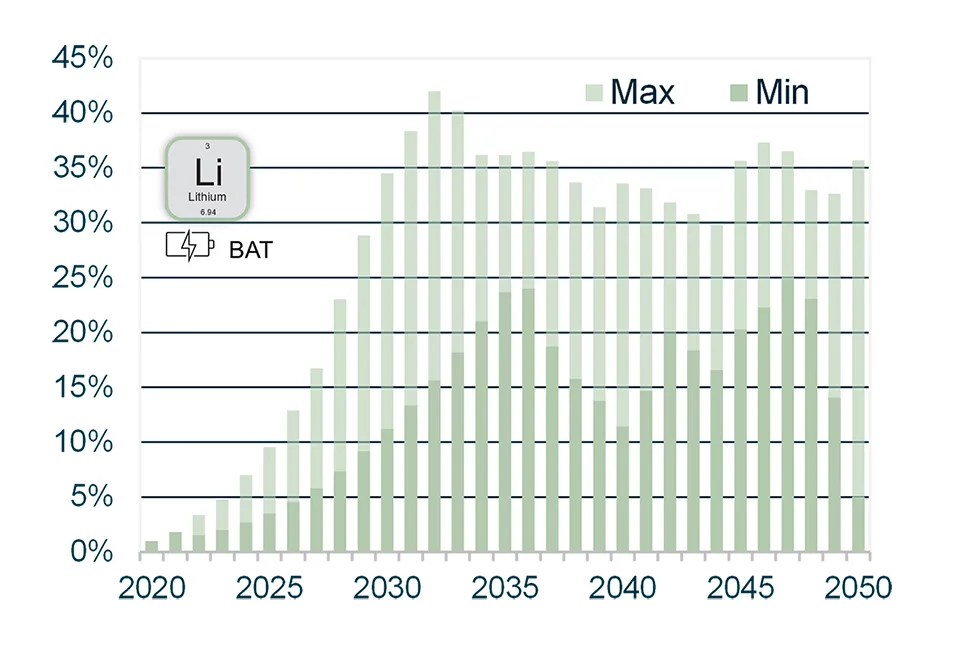

New Government-commissioned studies reveal that the UK may require as much as 40 per cent of the global lithium supply to meet anticipated demand by 2030.

13/03/2025 By BGS Press

Hosted by BGS, the UK Critical Minerals Intelligence Centre (CMIC) has quantified UK demand requirements and global supply challenges up to 2050 for 36 materials important to nine technologies essential to decarbonisation and the energy transition:

• batteries

• electrolysers

• fuel cells

• grid infrastructure

• heat pumps

• nuclear

• photovoltaics

• traction motors

• wind turbines

This has highlighted the vulnerability of the UK in competing for a secure and reliable supply of critical resources.

The newly released foresight studies project that, by 2030, the UK is expected to require between 15 and 40 per cent of current global lithium production and between 10 and 29 per cent of current global graphite production. Compared to 2020 levels, UK demand in 2030 for lithium is expected to increase by between 12 and 45 times the current demand, while graphite demand is projected to grow by between 34 and 43 times. Both materials are essential for rechargeable lithium-ion batteries, which power electric vehicles, consumer electronics and energy storage systems.

Annual UK demand as a percentage of global production for lithium, shown as the minimum (dark shade) and maximum (light shade) demand of the National Grid scenarios. Global production figures are the five-year average (2017 to 2021) from the BGS World Mineral Statistics Database. BGS © UKRI 2025.

Ensuring a secure and stable supply for these materials presents a major challenge. To meet the global demand forecasted by the International Energy Agency, lithium supply alone would need to increase by 32 times by 2030, highlighting the pressure on supply chains and the urgency for secure, diversified, resilient and responsible supply.

The foresight studies, commissioned by the Department for Business & Trade, identified risks that could see bottlenecks in material supply due to limited UK-based supply chains, a reliance on international markets and growing global competition, all of which could have a detrimental impact on the economy.

The approach taken to quantify demand for specific technologies, while also providing a comprehensive overview across various decarbonisation technologies, is unique. This methodology enables the UK to make strategic decisions to enhance the security of the supply chains these technologies depend on.

Dr Evi Petavratzi, foresight study lead at CMIC.

Batteries have been identified as the decarbonisation technology that will see the fastest demand growth in the UK, which will have a knock-on-effect on the amount of materials, including graphite, nickel, lithium, cobalt and manganese, needed to meet this demand. Heat pumps, traction motors and wind turbines will drive demand for copper and rare earth elements (REEs). UK demand for REEs is expected to peak around 2030, before stabilising at approximately 5 per cent of current global supply by 2040, which underscores the critical need for new supply streams to be operational by 2030.

The foresight reports and data can be found on the CMIC website, as can the UK Critical Minerals Assessment, which was released in November 2024.

Relative topics

Related news

Funding awarded to UK/Canadian critical mineral research projects

08/07/2025

BGS is part of a groundbreaking science partnership aiming to improve critical minerals mining and supply chains.

Release of over 500 Scottish abandoned-mine plans

24/06/2025

The historical plans cover non-coal mines that were abandoned pre-1980 and are available through BGS’s plans viewer.

Goldilocks zones: ‘geological super regions’ set to drive annual £40 billion investment in jobs and economic growth

10/06/2025

Eight UK regions identified as ‘just right’ in terms of geological conditions to drive the country’s net zero energy ambitions.

UK Minerals Yearbook 2024 released

21/05/2025

The annual publication provides essential information about the production, consumption and trade of UK minerals up to 2024.

New interactive map viewer reveals growing capacity and rare earth element content of UK wind farms

16/05/2025

BGS’s new tool highlights the development of wind energy installations over time, along with their magnet and rare earth content.

Latest mineral production statistics for 2019 to 2023 released

28/04/2025

More than 70 mineral commodities have been captured in the newly published volume of World Mineral Production.

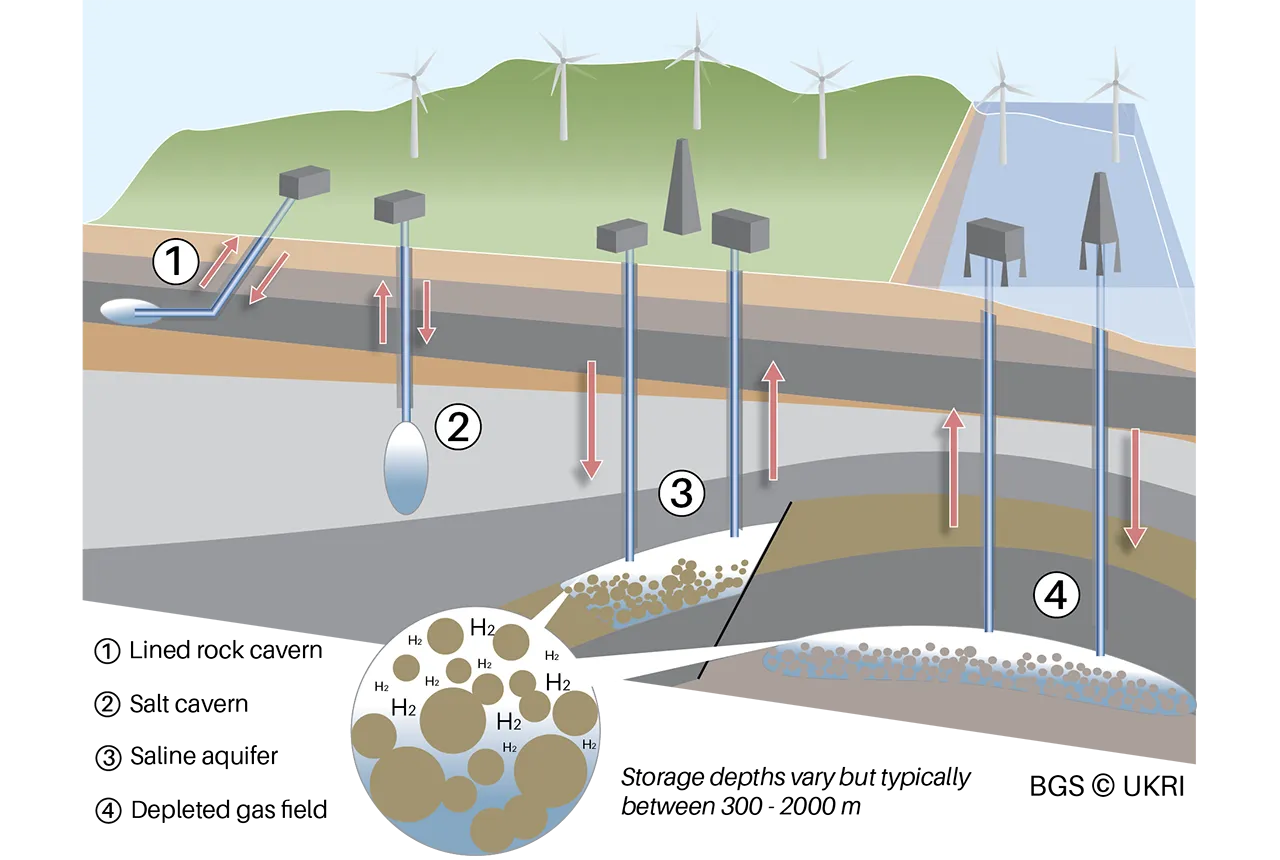

Making the case for underground hydrogen storage in the UK

03/04/2025

A new BGS science briefing note focuses on the potential of hydrogen storage to support the UK energy transition.

New data reveals latest mineral workings around Great Britain and Northern Ireland

01/04/2025

The newest release of BGS BritPits provides information on an additional 6500 surface and underground mineral workings.

Exploring Scotland’s hidden energy potential with geology and geophysics: fieldwork in the Cairngorms

31/03/2025

BUFI student Innes Campbell discusses his research on Scotland’s radiothermal granites and how a fieldtrip with BGS helped further explore the subject.

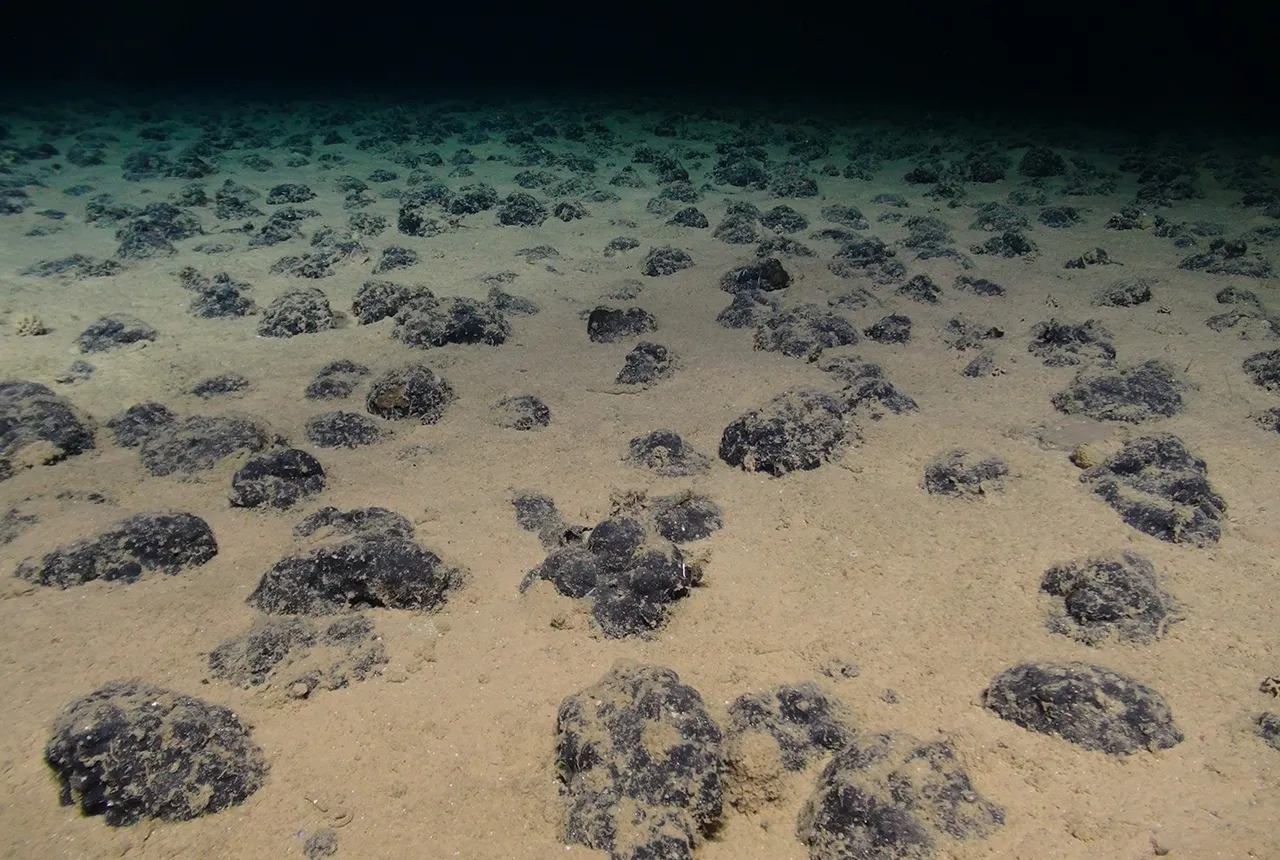

New study reveals long-term effects of deep-sea mining and first signs of biological recovery

27/03/2025

BGS geologists were involved in new study revealing the long-term effects of seabed mining tracks, 44 years after deep-sea trials in the Pacific Ocean.

Future projections for mineral demand highlight vulnerabilities in UK supply chain

13/03/2025

New Government-commissioned studies reveal that the UK may require as much as 40 per cent of the global lithium supply to meet anticipated demand by 2030.

Critical Mineral Intelligence Centre hosts second conference

28/02/2025

The Critical Minerals Intelligence Centre conference took place at BGS’s headquarters in Keyworth, Nottinghamshire.