Future projections for mineral demand highlight vulnerabilities in UK supply chain

New Government-commissioned studies reveal that the UK may require as much as 40 per cent of the global lithium supply to meet anticipated demand by 2030.

13/03/2025 By BGS Press

Hosted by BGS, the UK Critical Minerals Intelligence Centre (CMIC) has quantified UK demand requirements and global supply challenges up to 2050 for 36 materials important to nine technologies essential to decarbonisation and the energy transition:

• batteries

• electrolysers

• fuel cells

• grid infrastructure

• heat pumps

• nuclear

• photovoltaics

• traction motors

• wind turbines

This has highlighted the vulnerability of the UK in competing for a secure and reliable supply of critical resources.

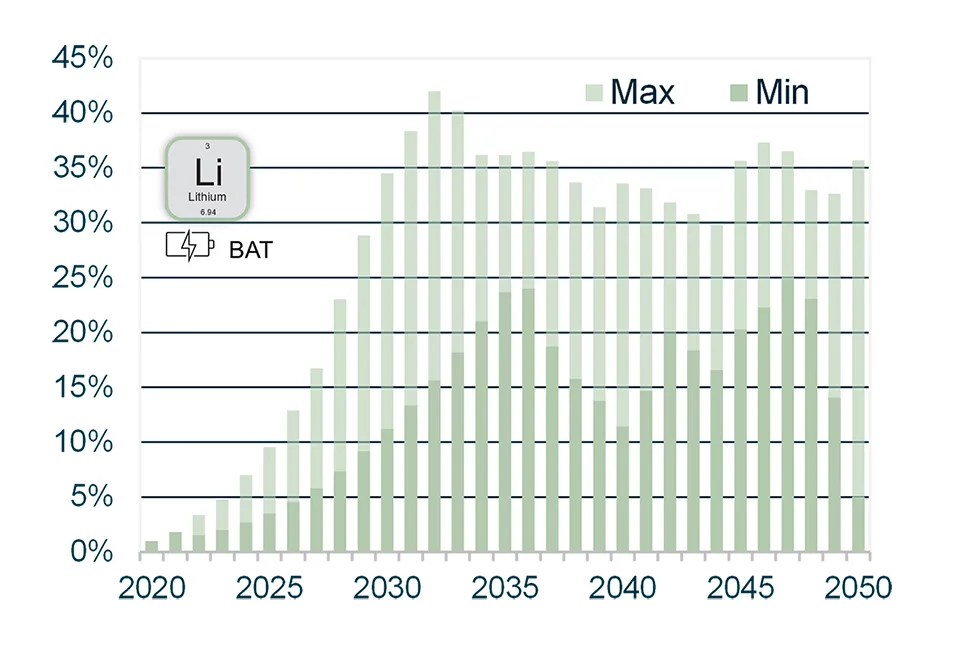

The newly released foresight studies project that, by 2030, the UK is expected to require between 15 and 40 per cent of current global lithium production and between 10 and 29 per cent of current global graphite production. Compared to 2020 levels, UK demand in 2030 for lithium is expected to increase by between 12 and 45 times the current demand, while graphite demand is projected to grow by between 34 and 43 times. Both materials are essential for rechargeable lithium-ion batteries, which power electric vehicles, consumer electronics and energy storage systems.

Annual UK demand as a percentage of global production for lithium, shown as the minimum (dark shade) and maximum (light shade) demand of the National Grid scenarios. Global production figures are the five-year average (2017 to 2021) from the BGS World Mineral Statistics Database. BGS © UKRI 2025.

Ensuring a secure and stable supply for these materials presents a major challenge. To meet the global demand forecasted by the International Energy Agency, lithium supply alone would need to increase by 32 times by 2030, highlighting the pressure on supply chains and the urgency for secure, diversified, resilient and responsible supply.

The foresight studies, commissioned by the Department for Business & Trade, identified risks that could see bottlenecks in material supply due to limited UK-based supply chains, a reliance on international markets and growing global competition, all of which could have a detrimental impact on the economy.

The approach taken to quantify demand for specific technologies, while also providing a comprehensive overview across various decarbonisation technologies, is unique. This methodology enables the UK to make strategic decisions to enhance the security of the supply chains these technologies depend on.

Dr Evi Petavratzi, foresight study lead at CMIC.

Batteries have been identified as the decarbonisation technology that will see the fastest demand growth in the UK, which will have a knock-on-effect on the amount of materials, including graphite, nickel, lithium, cobalt and manganese, needed to meet this demand. Heat pumps, traction motors and wind turbines will drive demand for copper and rare earth elements (REEs). UK demand for REEs is expected to peak around 2030, before stabilising at approximately 5 per cent of current global supply by 2040, which underscores the critical need for new supply streams to be operational by 2030.

The foresight reports and data can be found on the CMIC website, as can the UK Critical Minerals Assessment, which was released in November 2024.

Relative topics

Related news

BGS agrees to establish collaboration framework with Ukrainian government

11/12/2025

The partnership will focus on joint research and data exchange opportunities with Ukrainian colleagues.

Making research matter: BGS joins leading research organisations in new national initiative

10/12/2025

A new alliance of 35 organisations has been formed that is dedicated to advancing science for the benefit of people, communities, the economy and national priorities.

BGS welcomes publication of the UK Critical Minerals Strategy

23/11/2025

A clear strategic vision for the UK is crucial to secure the country’s long-term critical mineral supply chains and drive forward the Government’s economic growth agenda.

New funding awarded for UK geological storage research

21/11/2025

A project that aims to investigate the UK’s subsurface resource to support net zero has been awarded funding and is due to begin its research.

How the geology on our doorstep can help inform offshore infrastructure design

19/11/2025

BGS is part of a new collaboration using onshore field work to contextualise offshore data and update baseline geological models which can inform the sustainable use of marine resources.

Funding awarded for study on hydrogen storage potential in North Yorkshire

22/09/2025

A new study has been awarded funding to explore the potential for underground hydrogen storage near the Knapton power plant.

New geological ‘pathways’ discovered beneath Welsh capital

02/09/2025

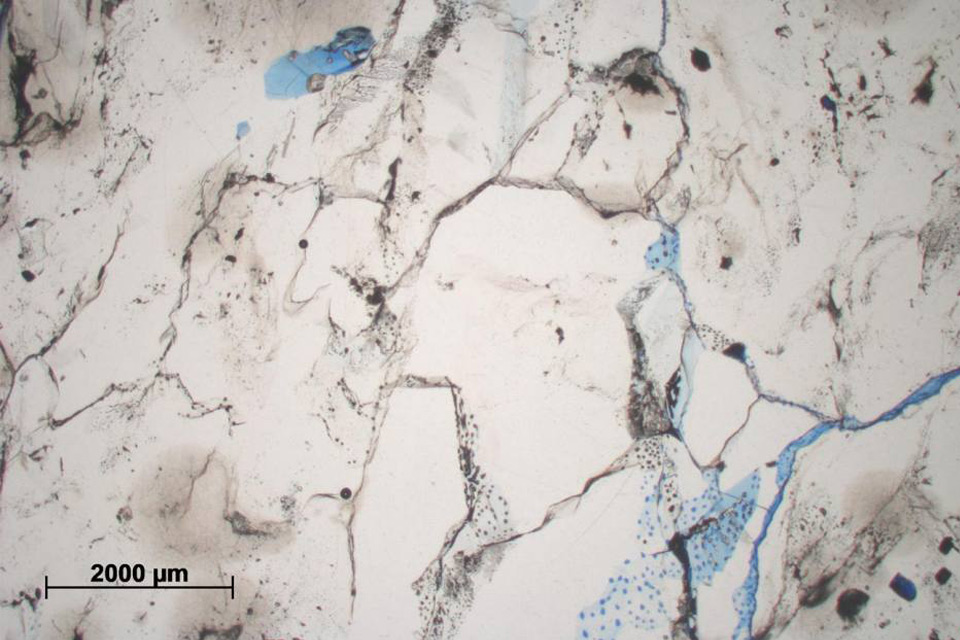

Scientists have discovered cavities in the clay underneath Cardiff, which will influence the siting of future geothermal developments.

Dr Kathryn Goodenough appointed as honorary professor by the University of Aberdeen

25/08/2025

Dr Goodenough will take up the position within the School of Geosciences with a focus on critical minerals and the energy transition.

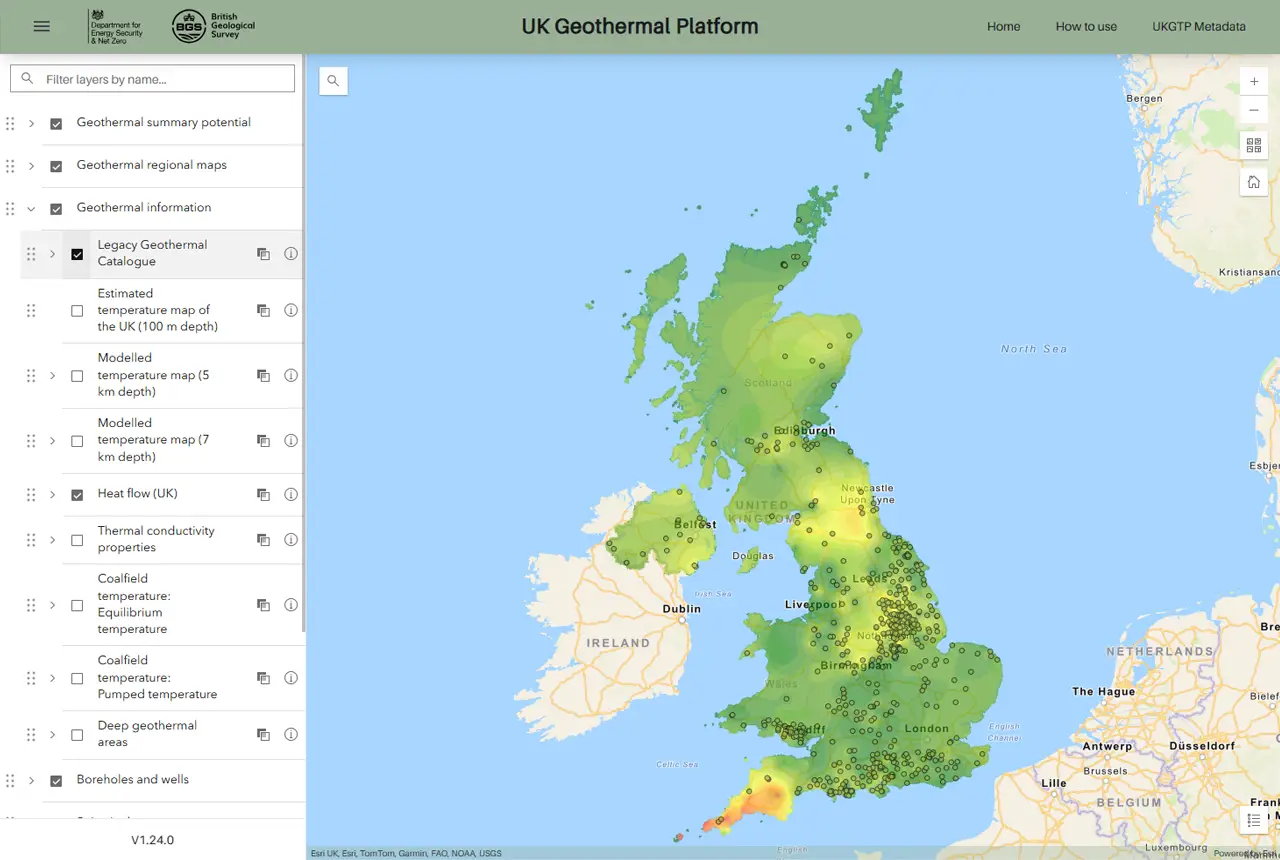

New platform highlights geothermal potential across the UK

11/08/2025

A new government-funded geothermal initiative, which includes an interactive map, has launched to help decision makers assess the geothermal potential across the UK.

BGS hosts India for ‘deep dive’ on carbon capture and storage

30/07/2025

Some of India’s top scientists visited BGS to explore the UK’s carbon dioxide storage research potential.

Zambia’s first critical minerals guide supports the country’s potential in global clean energy transition

18/07/2025

A new guide to Zambia’s critical minerals highlights the country’s current and potential critical mineral resources, including cobalt and lithium.

Funding awarded to UK/Canadian critical mineral research projects

08/07/2025

BGS is part of a groundbreaking science partnership aiming to improve critical minerals mining and supply chains.