New study reveals geological facility’s value to UK economy

For the first time, an economic valuation report has brought into focus the scale of the National Geological Repository’s impact on major infrastructure projects.

19/08/2025 By BGS Press

The National Geological Repository (NGR) is a gateway to our shared subsurface. It is the UK’s most comprehensive collection of geological materials, consisting of over 16 million specimens and assembled over 200 years. The collection acts as both an evidence base of previous scientific endeavours and a resource for new and future research.

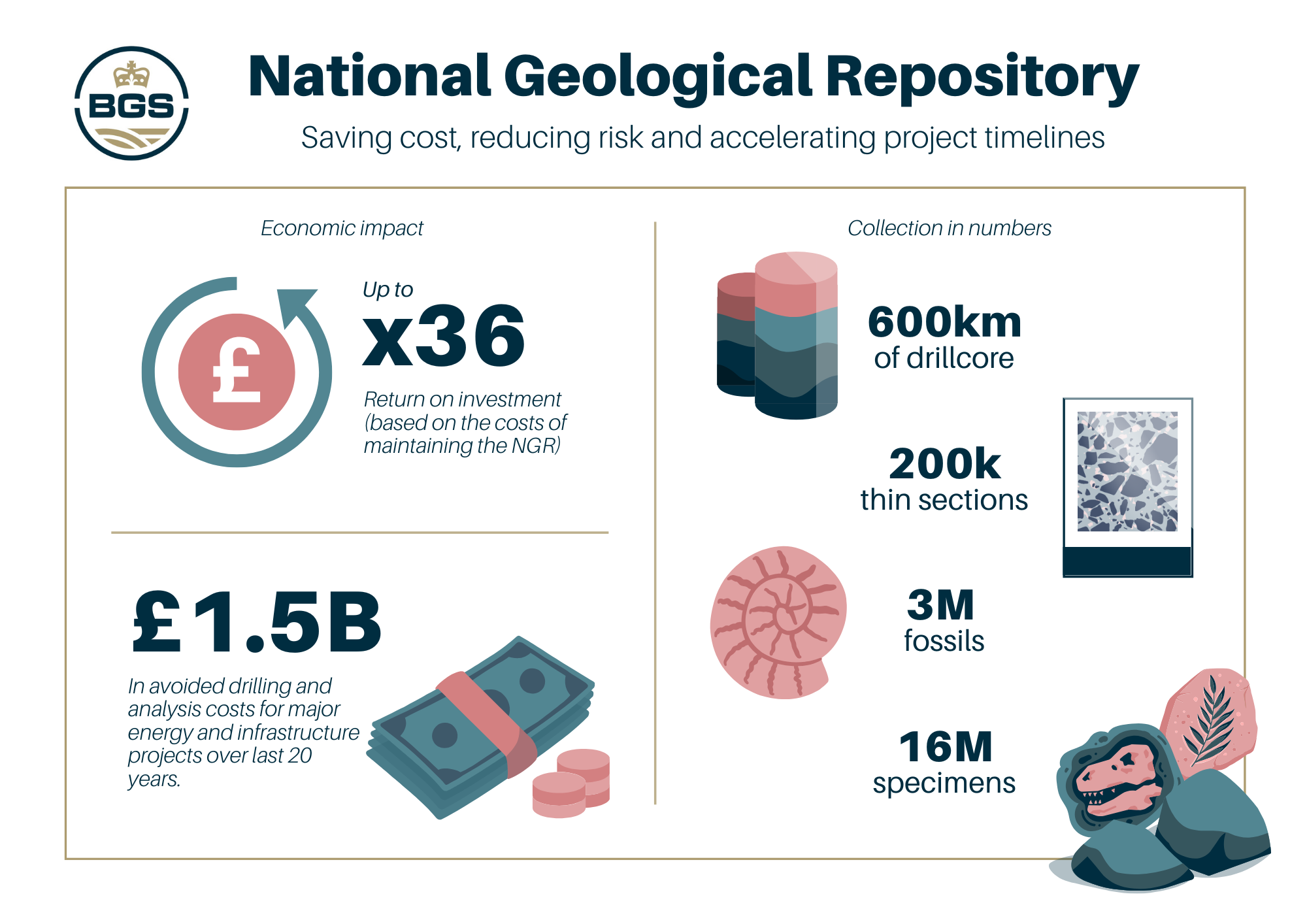

The economic analysis shows that the NGR saves major energy and infrastructure projects significant costs through access and re-use of pre-drilled rock core:

- £1.5 billion in avoided drilling and analysis costs for major energy and infrastructure projects over the last 20 years

- Up to 36 times return on investment based on costs of maintaining the facility

- Time-savings of around three years per infrastructure project through access to legacy core samples

These returns are underpinned by the high costs of drilling new boreholes. It can cost more to drill an onshore borehole than run the NGR for a year and this can rise by a factor of 20 for offshore drilling.

Key metrics from the National Geological Repository economic valuation report.

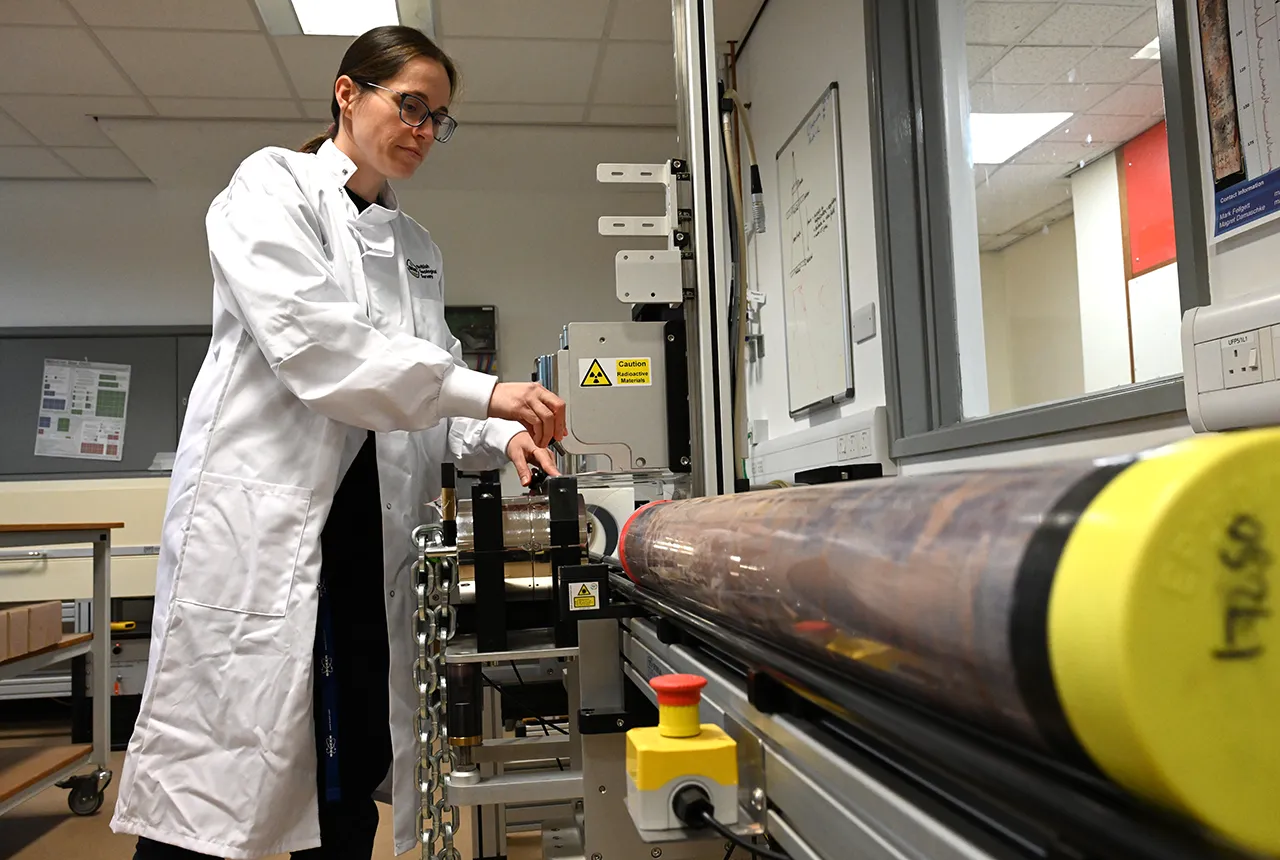

Located at BGS’s headquarters in Keyworth, the NGR is home to the UK’s largest core storage and examination facility. Of particular value to industry and infrastructure projects are over 600 km of pre-drilled core from around the UK, which provide considerable cost and time-saving benefits.

“The BGS’ core facility (the National Geological Repository) is invaluable in enabling researchers to use legacy geological materials and data for new purposes in the transition to low-carbon energy.”

Gary Hampson, Professor of Sedimentary Geology, Imperial College London

“These cores were acquired at significant expense (often multiple hundreds of thousands of pounds per core) from offshore wells, specifically targeting areas of fundamental uncertainty in subsurface geology. Their preservation offers substantial economic and environmental value, as the cost of re-sampling or drilling new cores is prohibitively high. Moreover, the carbon footprint associated with new drilling can be significantly reduced by utilising these existing core samples for further research and decision-making, aligning with sustainability and Net Zero ambitions.”

Nick Terrell, Industry Co-Chair, Subsurface Task Force

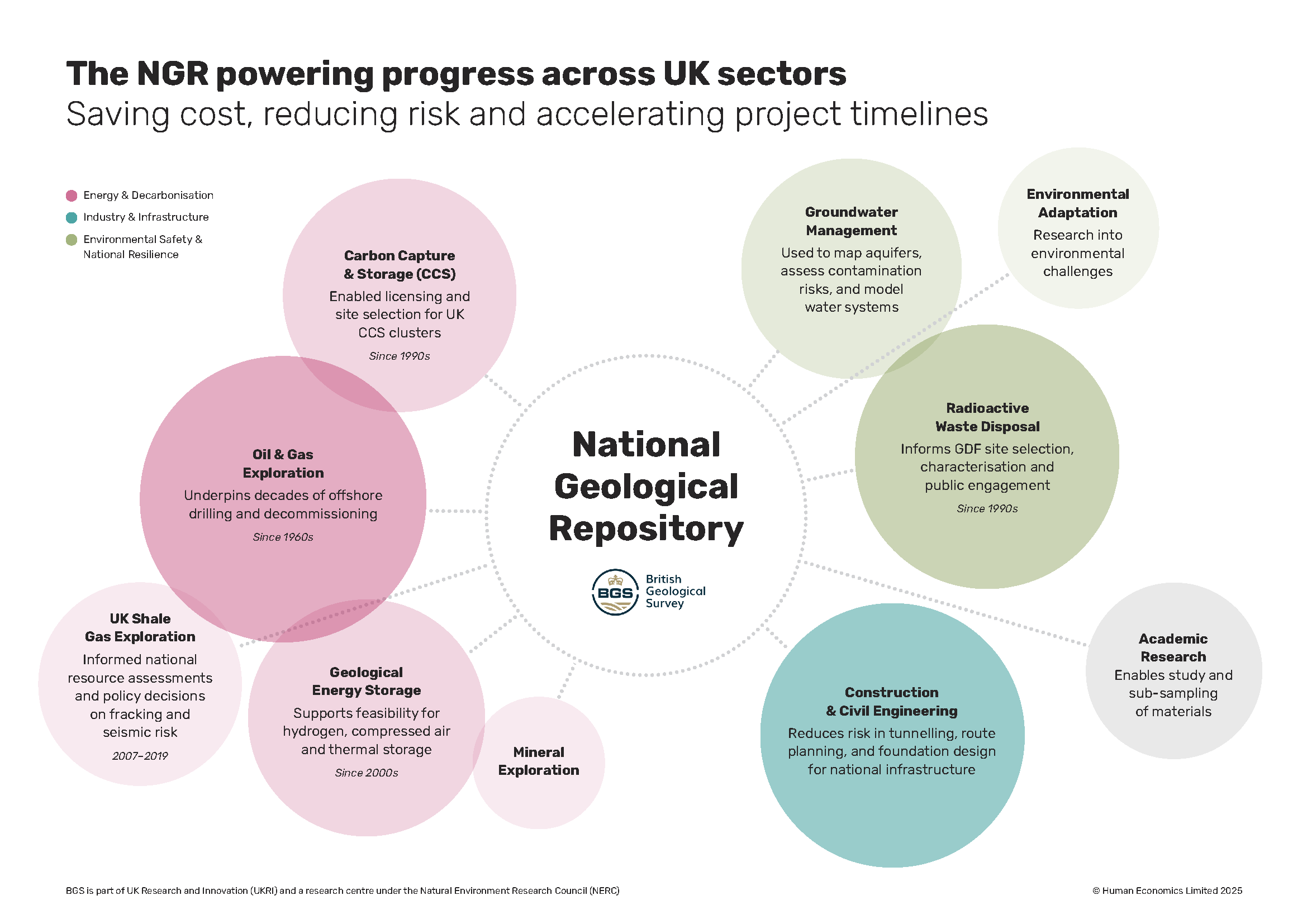

The facility is trusted by government, regulators and industry to enable faster, better-informed decisions and is poised to enable UK clean energy infrastructure projects, including geothermal and carbon capture and storage.

Importance of the NGR across UK sectors. © Human Economics Limited 2025

As well as quantifying the impact of the NGR, the report also highlights a series of constraints that could limit the facility’s ability to deliver increased public value in future. Expansion will be required to accommodate further core acquisitions. This is vital as many present-day drilling operations are occurring in areas with potential for net zero technologies or mineral prospectivity, meaning the opportunity to re-use the core is high. Further potential lies in digitising the collection, as only a fraction of the physical holdings has been digitised to date, limiting the facility’s ability to deliver comprehensive remote access.

BGS is exploring investment opportunities to secure and enhance the NGR’s long-term future and national value.

Relative topics

Related news

Scientists gain access to ‘once in a lifetime’ core from Great Glen Fault

01/12/2025

The geological core provides a cross-section through the UK’s largest fault zone, offering a rare insight into the formation of the Scottish Highlands.

Why do we store geological core?

11/09/2025

With space at a premium and the advance of new digitisation techniques, why does retaining over 600 km of physical specimens remain of national importance?

New study reveals geological facility’s value to UK economy

19/08/2025

For the first time, an economic valuation report has brought into focus the scale of the National Geological Repository’s impact on major infrastructure projects.

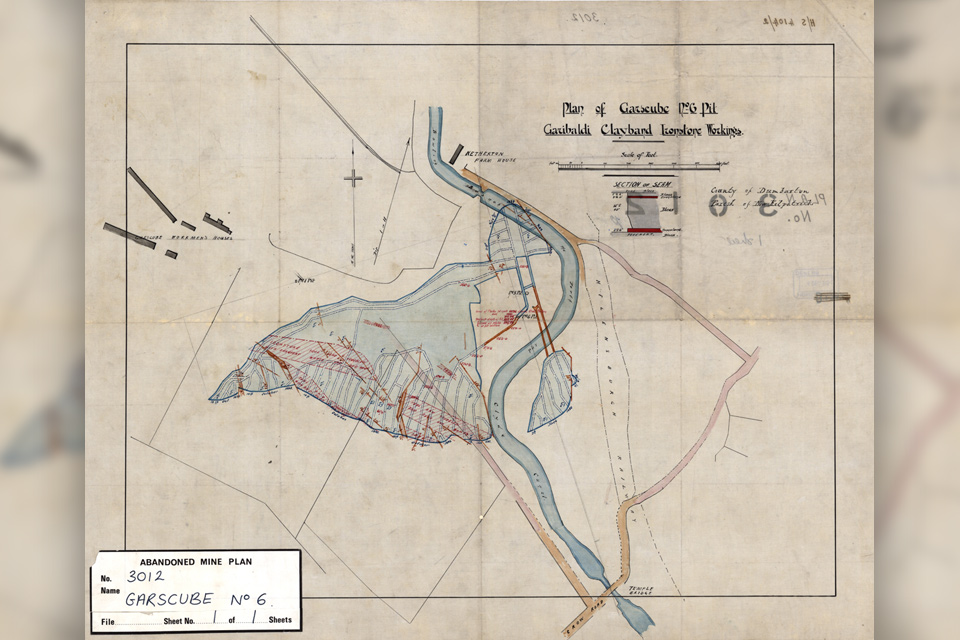

Release of over 500 Scottish abandoned-mine plans

24/06/2025

The historical plans cover non-coal mines that were abandoned pre-1980 and are available through BGS’s plans viewer.

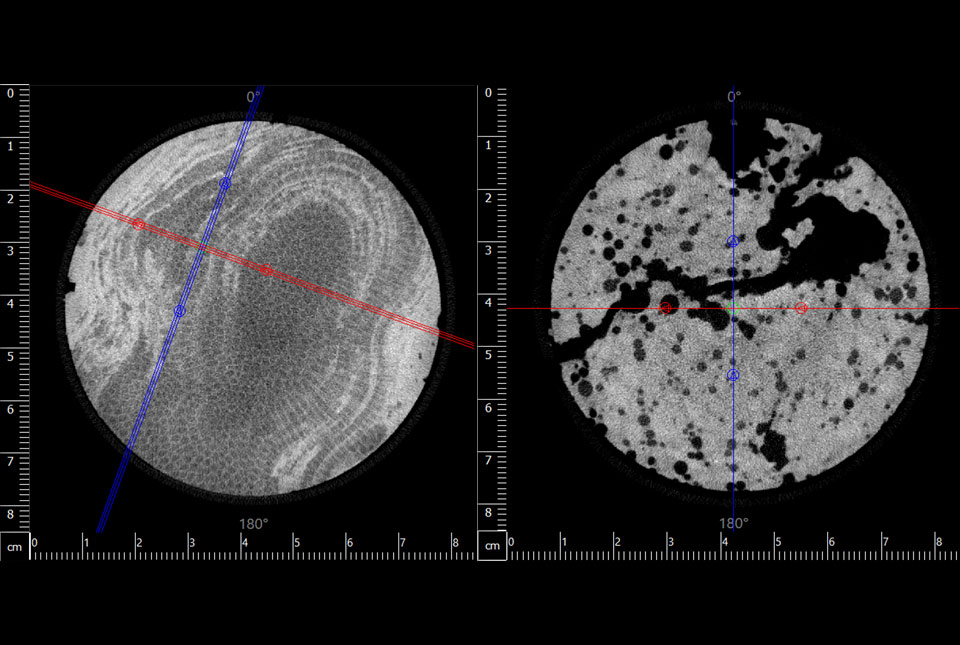

Prehistoric power: 250-million-year-old rocks could contain secrets to net zero future

05/12/2024

BGS has completed a comprehensive scan of Mercia Mudstone rocks that could hold geological secrets of the UK’s past and provide a boost for net zero.

BGS’s National Geoscience Data Centre releases over 8000 technical reports

05/06/2024

The technical reports, covering the full spectrum of BGS activities and subjects, were produced between 1950 and 2000.

Largest CT core scan completed at the BGS Core Scanning Facility

09/05/2024

BGS has completed its largest CT core scan project to date, with around 400 m of core imaged for the IODP Drowned Reefs project.

New underground observatory open for research

09/04/2024

Construction has been completed on the Cheshire Observatory and the facility is now open for research activities.

Unlocking key mineral archives at the Zambian Geological Survey Department

23/02/2024

Rachel Talbot recounts a recent visit by BGS Records staff to the Zambian Geological Survey Department, to assist in critical mineral data management.

The art of boreholes: Essex artists visit the BGS to be inspired by our library of geological core

02/11/2023

Two UK-based artists visitors aim to turn art and earth science into a collaborative experience that facilitates discussion on land usage.

Boreholes aren’t boring!

31/07/2023

Work experience student Patrick visited BGS to learn more about being a professional rock lover.

Mineral investigation reports released online

07/07/2023

Reports from over 260 mineral exploration projects are now freely available on BGS’s GeoIndex.